Posted by Dr Bouarfa Mahi on 10 Dec, 2024

Financial markets are a playground of complexity, unpredictability, and potential. For decades, time-series analysis has dominated financial modeling, with analysts and quants relying on the time parameter to make sense of price movements, trends, and volatility. But what if the time parameter is not essential to building the ideal prediction model?

This blog explores a bold conjecture that challenges traditional market paradigms:

"The ideal prediction model in financial markets does not explicitly contain the time parameter, focusing instead on a space-phase-based approach."

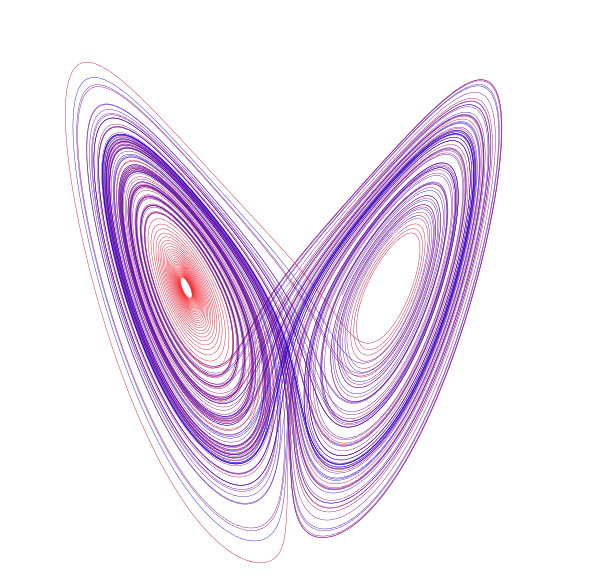

At its core, the conjecture suggests that market dynamics can be better understood through relationships and states rather than by tracking the passage of time. Instead of modeling events as a sequence tied to specific timestamps, this approach envisions a multidimensional space where key market variables interact, forming identifiable phases or states.

For example:

While time is an intuitive and convenient organizing principle, it may introduce unnecessary constraints in financial modeling:

Noise and Irregularities

Short-Term Uncertainty

Temporal Dependencies

A space-phase-based approach focuses on states and relationships rather than sequences. Here's why this shift makes sense:

Market States

Time-Agnostic Dynamics

Structural Simplicity

"The ideal prediction model in financial markets does not explicitly contain the time parameter, focusing instead on relationships and market states in a multidimensional space-phase representation."

This conjecture builds on concepts from dynamical systems and physics, where time is often a derived variable rather than a fundamental one. Similarly, in financial markets, the evolution of prices and other variables may depend more on their current state than on specific timestamps.

Adaptability Across Timeframes

Robustness

New Insights

To explore this conjecture, consider the following applications:

Clustering Market States

Use machine learning to group similar market conditions into clusters (e.g., trending, mean-reverting, high-volatility states).

Example: Apply unsupervised learning algorithms like k-means or DBSCAN to identify market phases.

Phase-Space Representation

Represent market dynamics in a multidimensional space, where dimensions include variables like price levels, volatility, and volume.

Example: Map price changes and volume imbalances to predict transitions between states.

Risk Management

While promising, the space-phase-based approach faces hurdles that require further exploration:

Defining Market Phases

Computational Complexity

Validation

This conjecture is an invitation to rethink financial modeling. Here’s how researchers, quants, and traders can contribute:

Pilot Experiments

Open Collaboration

Real-World Testing

The idea of excluding time from financial prediction models is both radical and refreshing. By shifting the focus to relationships and states, we open the door to new ways of understanding market behavior—potentially uncovering insights that have been overlooked by traditional methods.

As we embark on this journey, the question remains: Could a space-phase-based model truly outperform the time-bound paradigms of the past?

What do you think about this conjecture? Let’s discuss!