Posted by Dr Bouarfa Mahi on 17 Jan, 2025

This article explores a novel perspective on the dynamics of financial markets by integrating theological concepts with machine learning principles. Drawing from Proverbs 16:11

"Plans are made in human hearts, but from the Lord comes the tongue’s response"

we propose a conjecture that God's influence operates at the spiritual level, subtly guiding market decisions. By modeling traders as neurons within a neural network, where the body, soul, and spirit correspond to distinct decision-making layers, we suggest that divine influence functions by adjusting the "weights" within this network. This framework offers a compelling explanation for the unpredictable yet purposeful nature of financial markets.

Financial markets are traditionally viewed as complex systems driven by data analysis, economic indicators, and human psychology. Traders employ sophisticated models and strategies to predict market behavior, yet markets often defy logic through sudden crashes, rallies, or inexplicable trends. These phenomena raise a critical question:

Are market outcomes solely the result of human action, or is there a higher influence at play?

Rooted in the biblical wisdom of Proverbs 16:1, this article introduces a model where traders are likened to neurons in a neural network, and divine influence manifests through adjustments in decision-making weights. By incorporating the theological understanding3 of humans as beings composed of body, soul, and spirit, this model bridges spiritual belief with financial theory.

The human decision-making process can be broken down into three distinct but interconnected components:

In machine learning, neural networks are computational models inspired by the human brain4. Each neuron processes inputs, applies weights, and produces an output. This structure mirrors human decision-making in the financial market.

The decision function of a trader (

Where:

Let's break it down and interpret each component:

Market Input Factors

These are external financial indicators or market variables influencing the trader's decision. Examples include price movements, volume, news sentiment, or technical indicators.

Trader's Inherent Decision Weight

This represents how strongly trader

Divine Adjustment

This is an abstract but profound term. It introduces an external or unforeseen influence (intuition, luck, or subconscious insight) that subtly adjusts the trader's inherent biases. In this framework, it specifically models how God communicates through the human spirit, guiding decisions in subtle and often imperceptible ways. This integration acknowledges that decision-making can be influenced by spiritual insights beyond human understanding, reflecting the theological belief that the human spirit serves as a channel for divine guidance.

Emotional Bias

This term models the emotional state of the trader, acknowledging that emotions like fear, greed, or overconfidence can skew decisions. Connecting this to the soul emphasizes the emotional and psychological depth of human decision-making.

Activation Function

A nonlinear function like the sigmoid

In this model, God's influence is not forceful but operates by subtly adjusting the weights (

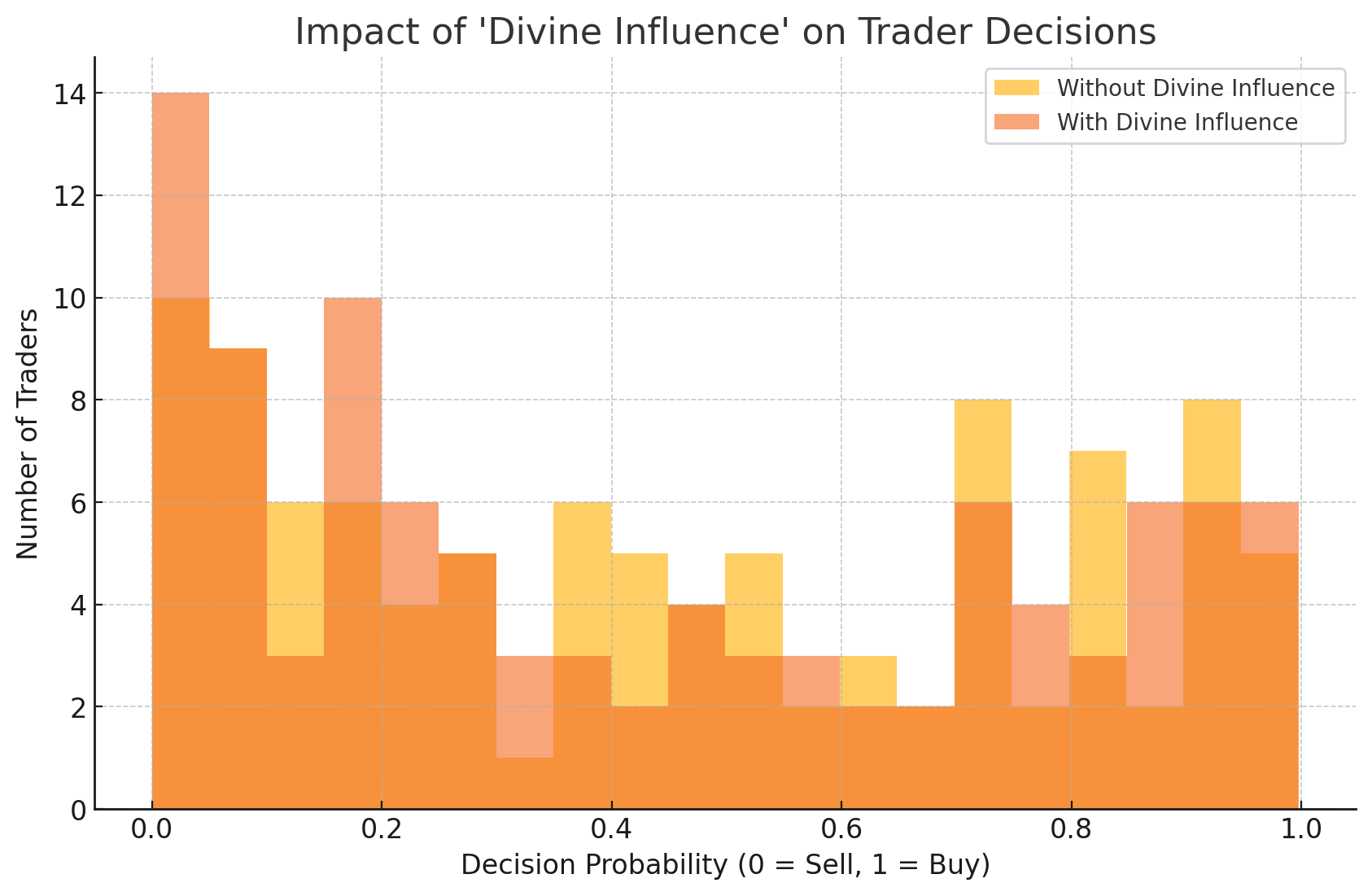

To illustrate this theory, we simulated market behavior using a neural network model of 100 traders.

Sigmoid Activation Function: This function is used to simulate the decision-making process, where the output is a probability between 0 and 1. A value closer to 1 indicates a decision to buy, while a value closer to 0 indicates a decision to sell.

Market Input Factors: Random market input factors are generated for each trader. These factors could represent various influences like market data, trends, and news.

Weights and Biases: Random weights and biases are initialized for each trader. These represent the individual trader's preferences and biases in decision-making.

Decision-Making Without Divine Influence: The decisions are calculated using the sigmoid function, based on the market inputs and the initial weights and biases.

Divine Influence: A "divine influence" is introduced by adjusting the weights slightly. This influence is simulated by adding a small positive or negative shift to the weights.

Decision-Making With Divine Influence: The decisions are recalculated using the adjusted weights.

Plotting the Results: The decisions with and without divine influence are plotted as histograms to compare their distributions.

The simulation compared two scenarios:

Here is the generated plot visualizing the impact of Divine Influence on trader decisions:

Without Divine Influence: Decisions are purely driven by market inputs, resulting in a balanced distribution of buying and selling tendencies.

With Divine Influence: Adjusting the "weights" slightly (analogous to divine intervention) causes a noticeable shift in the distribution, leading more traders to lean towards either buying or selling.

This model demonstrates how small, targeted influences can significantly impact collective market behavior, supporting the conjecture that divine adjustments in decision-making could drive market outcomes.

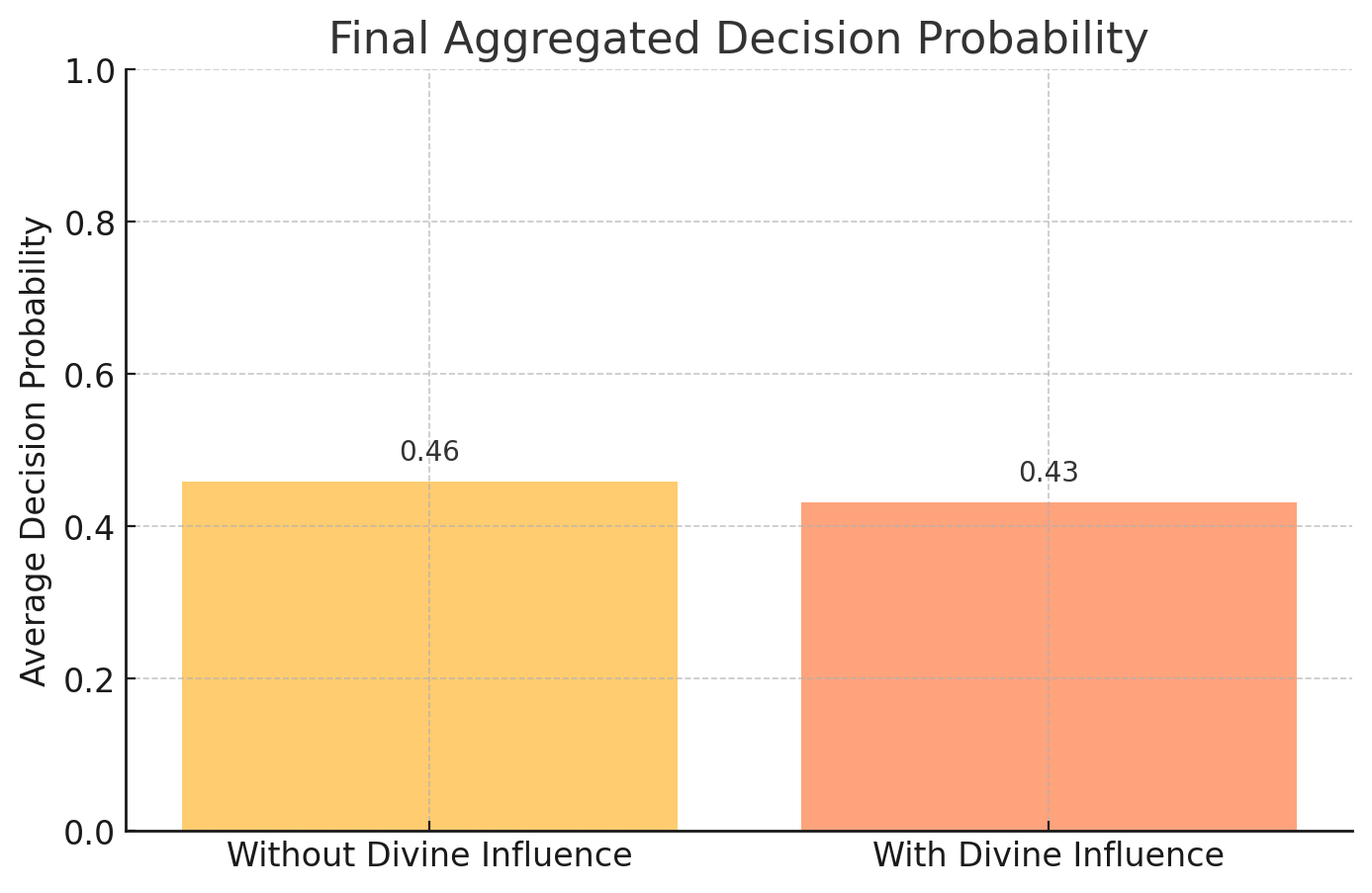

The final decision combines the individual decisions of all traders:

Where:

-

-

- If

Final Aggregated Decision Probability:

- This bar chart compares the average decision probability for both scenarios.

- It clearly shows how divine influence affects the overall market tendency to buy (1) or sell (0).

This model supports the theological view that while humans exercise free will in their decisions, God can guide collective outcomes through spiritual influence. By adjusting the "weights" in the decision-making process, God steers market trends without violating individual autonomy.

Market anomalies—sudden crashes, rallies, or trends without clear causes—could be interpreted as moments where divine influence shifts collective decision-making. This model offers a spiritual explanation for the unpredictability of financial markets.

If markets are influenced by divine will, ethical investing and moral decision-making may carry more weight than previously assumed. Traders and investors might consider aligning their strategies with ethical principles, recognizing that their success could be tied to higher purposes beyond profit.

This article presents a compelling conjecture:

Conjecture 1

God influences financial markets by subtly adjusting the decision-making weights within traders, much like a machine learning model fine-tunes its parameters.

By modeling traders as neurons and divine influence as weight adjustments, we offer a framework that merges spiritual belief with financial theory.

While this framework lacks empirical evidence for divine influence, it does not conflict with the foundation of quantitative finance. Instead, it expands the discipline by introducing an interpretive layer that acknowledges the unpredictability and complexity of market dynamics. This perspective challenges the notion that markets are purely driven by human analysis, suggesting instead that higher-order influences shape outcomes in ways beyond human understanding.

This model not only bridges finance and theology but also invites deeper reflection on the balance between free will and divine guidance in all aspects of life, offering a richer understanding of decision-making in complex systems.

Further exploration could involve:

This article is an exploratory fusion of finance, theology, and machine learning. It is not intended as financial advice but rather as a philosophical framework for understanding the complexity of human decision-making and the potential for divine influence in market dynamics.